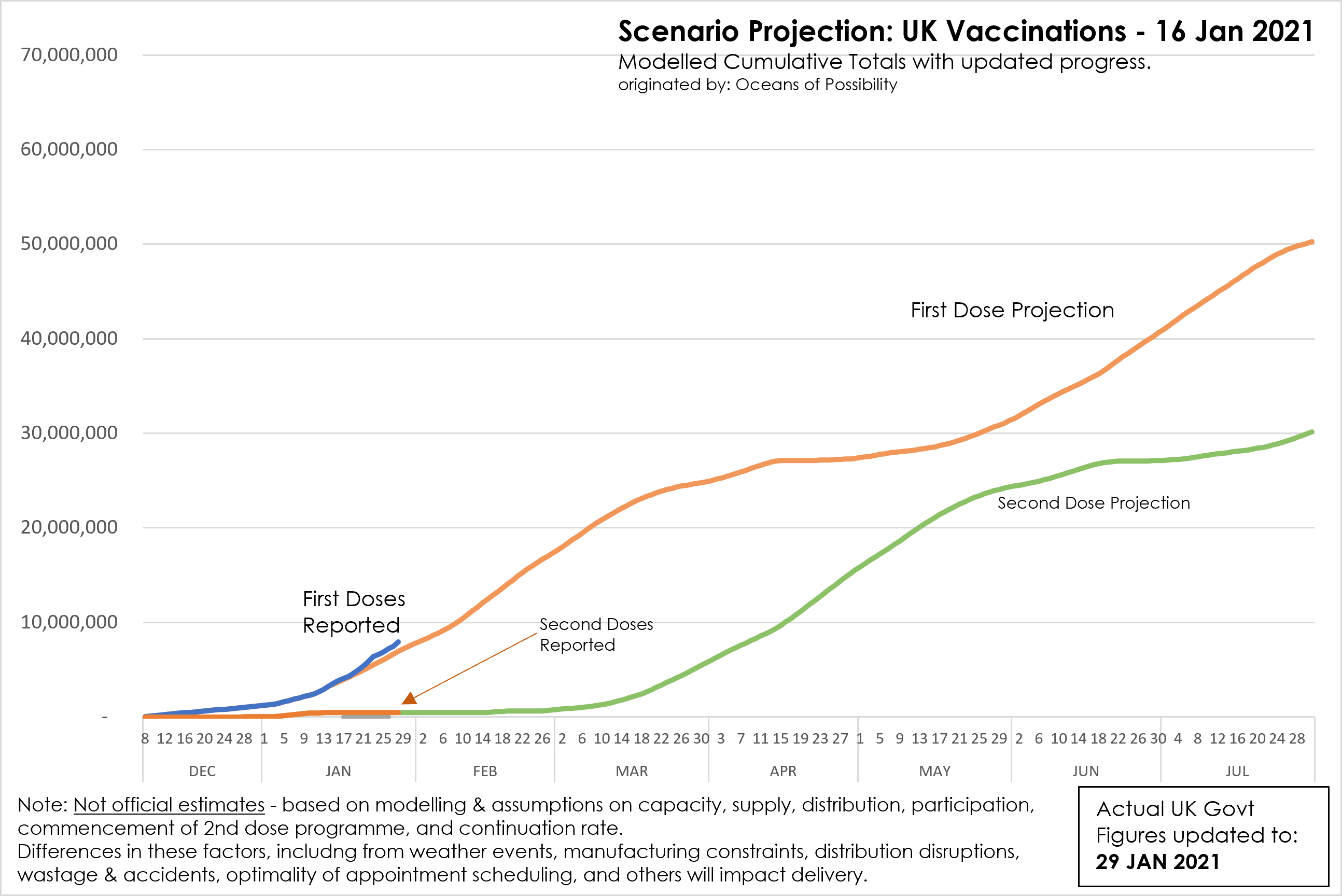

In the middle of January we created a scenario projection of the UK Vaccine Rollout – it was based on some public domain numbers, some speculation that we had picked up, and a lot of assumptions to fill in the gaps.

At the time the scenario was created the most recent (w/e 10 Jan 2021) full week’s average of first doses per day was c140k (i.e. just under 1m across the whole week) up from c 55k first doses per day (i.e. around 360k across the full week) in the preceeding week.

The reporting of vaccination sites opening was continual in early/mid January – so it was clear that capacity was ramping up and there were some rumours that jabbing capacity could increase to perhaps 500k per day in the coming weeks. A 2 million jabs per week figure was also being mentioned by ministers, MPs, and others.

So any forecast needed to include an expectation of a dramatic increase in the capacity to administer vaccinations – yet be tempered by some real-world issues that could prevent this capacity being fully utilised.

It also needed a reality check against public targets being quoted, and expected supply levels of the vaccine. (The expected supply was the most difficult as it was highly secretive, but an accidental, or deliberate, brief publication of Scotland’s expected vaccine supply helped give some ability to extrapolate a UK wide expectation and provide a sense check).

The scenario projection moved towards an expected capacity of vaccination jabs per day of almost 500k by early Feb, though not necessarily that all this capacity would be able to be used.

Against all of this was and is a likelihood that there will be some issues in supply volumes and in optimal distribution to vaccination sites, potential for some accidents or wastage (possibly especially with the more fragile Pfizer vaccine with more exacting requirements for transportation & storage at -80 degrees). There’s also the challenges of efficiently arranging vaccination appointments, the prospect of no-shows, and weather issues (some of which were on the horizon around the time of compiling the scenario) which could impact vaccine distribution, the vaccination sites themselves, or people’s ability to attend their appointments.

The peak expectation per day in the resultant projection was just over 400k vaccinations per day – at the time this seemed like an ambitious stretch, yet necessary to achieve the vaccination programme ambitions.

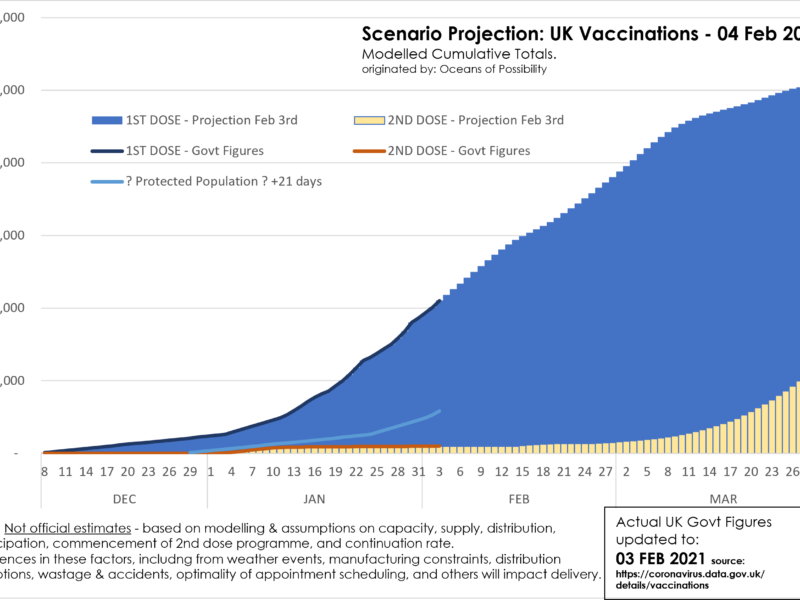

The projection estimates 12.5 million first jabs by 15 February which is likely to meet the Government’s target (see later for reasoning), though this is now starting to look a little cautious vs the progress over the second half of January.

An interesting feature of the longer interval between first and second jabs that the UK prioritisation is following is that whilst there will be a speedier work through the initial priority groups for their first jab – there will be an apparent slow-down in first jabbing once the second jabs start to be administered from mid-March (assumed). This may appear as the vaccine programme being delayed in moving onto the second phase groups (10+), and some frustration could develop for those waiting in line so to speak – but is required to deliver the full vaccination regemin.

However, it appears likely that all 9 initially identified priority groups (groups which account for 99% of deaths to date from Covid-19) could be first jabbed by late March (which has also been referred to by ministers as an expectation).

In mid-January there was also talk of Pfizer shutting down a production plant temporarily to enable a scale-up to increase production for the future – creating a temporary reduction in the immediate weeks, but an improvement overall over the coming months. It’s not yet clear whether this has or will impact the UK. It highlights though that issues can prevent a smooth flow of vaccines from factory to the field.

Of course in the last week of January the EU has entered into a row with Astra Zenica about expected supplies of its vaccine (even though the EMA until yesterday had not approved its use). This was extra-ordinary (especially its aggressiveness towards AZ vs the more placid stance that seemed to be taken with Pfizer over almost exactly the same issue as far as was evident). It perhaps shows the pressure the EU is under to deliver an effective vaccination programme that has been lack-luster to date.

Cutting through the hyperbole and noise however there is then a clarity that the production process of vaccines is extremely complex, with exacting quality standards, and usually production is ramped up over a longer period of time and prior to 2020 never so quickly as has been achieved at such massive volumes for new vaccines. The UK was fortuitous (strategic, wise, lucky, … ) to have committed early and at high volumes to a range of vaccines with underwriting of liabilities and production requirements. Whilst the UK has been insulated from production issues due to longer time frames to set its supply up, there have been several setbacks in the number of doses available to the UK vs expectations.

Our scenario projections are currently being exceeded by the actual progress of the vaccination programme and were it not for the spat last week between the EU and Astra Zenica, I would have revisited the projections to consider raising our expectations. However, it seems wise to pause and see if the spat dissipates or develops, and whether there may be any repercussions on the UK situation.

Further Background to the Scenario Projections.

In early January there was confident talk in government and by health commentators of the ability to meet a 2 million per week rate of vaccination and a target was being oft quoted to offer the first dose of the vaccination to all the top 4 priority groups that had been identified by the Joint Committee on Vaccination and Immunisation (JCVI) by mid-February (see below).

This target was clear in its aim, but not so clear in the number of vaccinations it would translate to – for 2 main reasons –

Firstly, the groups had some overlap in them – the main definitions were age based, but some additional definitions may overlap with each other or with the age definitions.

Secondly, offering the jab is not the same as administering the jab. This second issue initially seemed like a bit of a get out clause – people could be offered by 15 Feb, but not have had the jab. Imagine the number of invitations that could have been issued on Valentines Day to meet the target! But the reality is also that not all persons in the groups will choose to be vaccinated.

Understanding the target number is therefore a bit more complicated. A figure of 15million has been often quoted as the headline target number by 15 February – but a 13.9 million figure has also been quoted by the Health Secretary Matt Hancock (e.g. in a Radio 4 interview on 13 Jan 2021). There are estimates in the government UK Covid-19 Vaccines Delivery Plan of c15 million in the UK in the groups (including some overlap).

These would all seem to be estimates of the total number of people falling into the groups rather than the number accepting a vaccine jab.

The most successful previous vaccination programme is referred to in the Govt Plan as achieving 75% take-up. Prospects for the Covid-19 vaccine programme must hopefully be higher, given the serious impact that has been experienced from Covid-19 and the high priority that is being placed on its success – plus with the prioritising of anti-disinformation campaigns and proactive encouragement communications for the population as a whole and for minority groups in particular (where vaccine acceptance may be lower). In all likelihood our projection of 12.5 million first jabs by 15 February may well hit the Government’s target (currently Yougov’s monitor of vaccination willingness suggests c 83%, and rising, of adults in the UK will take a Covid-19 vaccine).

Top Priority Risk Groups defined by JCVI

| JCVI cohort | Priority group | England | UK | % deaths attributed to cohorts |

| Care home residents | 1 | 0.3m | 0.3m | – |

| Residential care workers | 1 | 0.4m | 0.5m | – |

| 80+ | 2 | 2.8m | 3.3m | – |

| Healthcare Workers | 2 | 2.0m | 2.4m | – |

| Social Care Workers | 2 | 1.2m | 1.4m | – |

| 75-79 | 3 | 1.9m | 2.3m | – |

| 70-74 | 4 | 2.7m | 3.2m | – |

| Clinically Extremely Vulnerable (under 70) | 4 | 1.0m | 1.2m | – |

| Total priority cohorts 1 to 4 | – | ~12m | ~15m | 88% |

| 65-69 | 5 | 2.4m | 2.9m | – |

| At Risk (under 65) | 6 | 6.1m | 7.3m | – |

| 60-64 | 7 | 1.5m | 1.8m | – |

| 55-59 | 8 | 2.0m | 2.4m | – |

| 50-54 | 9 | 2.3m | 2.8m | – |

| Total priority cohorts 5 to 9 | – | ~14m | ~17m | 11% |

| Total priority group population | – | ~27m | ~32m | 99% |

| Rest of adult population | – | ~18m | ~21m | – |

| Total | – | ~44m | ~53m | – |